Understand your revenue at a glance

You don’t need to be an accountant to read this dashboard.

The Financial Hub gives you a high‑level view of how your business is performing — and the details to back it up when you need them.

- Revenue over time – See how much you’ve collected this month, this term, or this year.

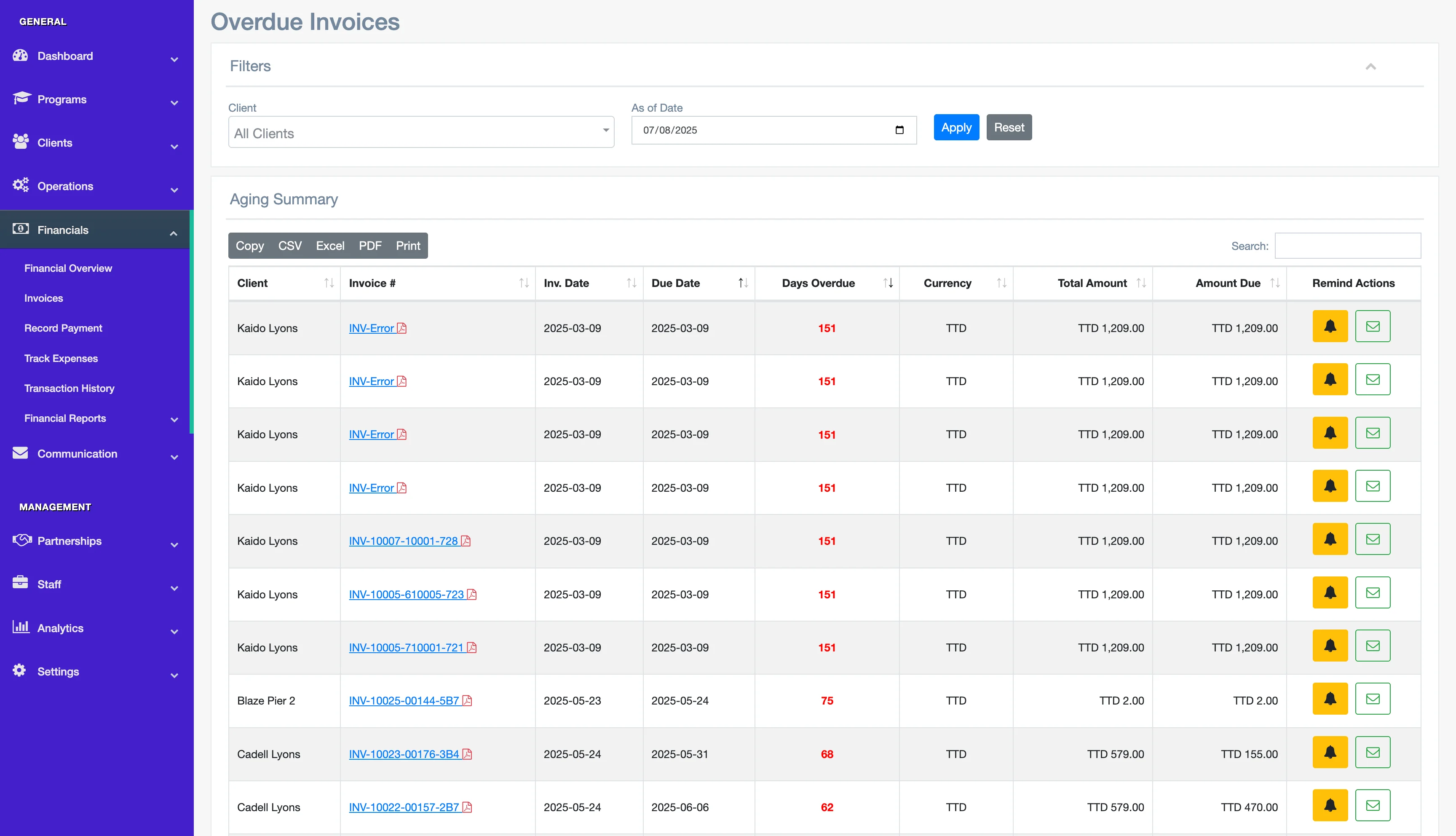

- Outstanding invoices – Quickly scan what’s overdue and what’s coming up.

- Payments received – Filter by date range to see money that actually landed in your account.

- Credits and refunds – Track applied credits and refunded amounts so your balances always add up.

Example Financial Hub dashboard showing revenue trends, outstanding invoices, and payments received.